Zero Contract Terminals

Looking for flexibility? No contract terminals are the perfect solution for businesses that don’t want to be tied down long-term.

Whether you’re a seasonal trader, a startup testing the waters, or just prefer to keep your options open, we work with several providers that offer rolling monthly plans or pay-as-you-go card machines.

Shift4

Card Machine Type: Terminal

Best For: Pubs, Restaurants, Cafés

Hardware Cost: Free

Transaction Fee: As low as 0.7% for all card types

Customer Support: 24/7 Customer Support

The Shift4 terminal is sleek standalone card machine, which comes with no-contract and a blended rate as low as 0.7%.

Businesses transacting less than £10k a month, will be charged for both credit and debit cards no more than 1.25% per transaction, with business over £10k per month paying just 0.70% per transaction.

There are no other fees such as rental costs, PCI fees, or minimum billing fees.

The card machines are completely free for the first one, with additional handsets costing just £15 per month. You can take payments immediately and can receive one in just a few days. Why don’t you try one, test it and then order more as required. There is a 30-day refund anyway.

Payments are transferred to your bank account in two days.

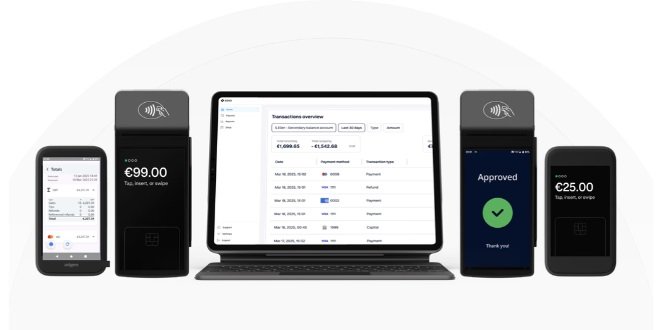

Zavo

Card Machine Type: Mobile or Terminal

Best For: All face to face businesses

Hardware Cost: £149

Transaction Fee: From 0.79%

Customer Support: Business hours

The Zavo Essential is a standalone card machine, ideal for Restaurants, Pubs, Cafés and other face to face businesses. It comes with a built-in SIM card for a reliable 4G connection. Zavo offer a blended rate flat rate of 0.79% and no monthly charges and next day payments.

Receive custom rates for businesses transacting over £20k per month. Get in touch for more information.

Overall, the Zavo Essential is a great, all-in-one payment solution for face-to-face businesses.

SumUp

Card Machine Type: Mobile

Best For: Customer Service

Hardware Cost: £79

Transaction Fee: From 0.99%

Customer Support: Business hours

The SumUp Solo is a pocket-sized, standalone card reader perfect for mobile businesses. It comes with a built-in SIM card offering unlimited data, meaning no need for a smartphone or tablet—just charge it up, and you’re ready to accept payments. With its intuitive touchscreen and pay-as-you-go pricing, SumUp makes it easy to manage payments with a flat 1.69% transaction fee and no monthly charges.

For fast cash flow, next-day payouts are made directly to a free SumUp Business Account, which includes a complimentary Mastercard for spending. It also offers features like smart tipping, sales reporting, and automatic updates to keep things running smoothly.

If you need printed receipts, the Solo can pair with an optional printer (£139) and double as a charging dock. However, it doesn’t have a keypad for manual entry, so it’s not ideal for phone payments.

Overall, the SumUp Solo is a sleek, all-in-one payment solution for businesses on the go.

Teya

Card Machine Type: Terminal

Best For: All face-to-face

Hardware Cost: £89

Transaction Fee: 1.49%

Customer Support: Business hours

The Teya Pro is a standalone card machine ideal for most business types. With a sleek design, impressive battery life, and lightning-fast transactions, it’s the ultimate payment solution. Teya makes it easy to manage payments with a blended rate of 1.49% and no monthly charges.

Overall, Teya is the ultimate solution for face-to-face businesses and businesses on the the go.

Tide

Card Machine Type: Mobile (4G)

Best For: Versatility & Bank Account

Hardware Cost: £59 + VAT

Transaction Fee: 1.5% for all transactions

Customer Support: Email support with a 48-hour response

The Tide Card Reader is an affordable, contract-free option for businesses needing a simple, mobile payment solution. At just £59 + VAT (promotional price), it supports payments via Visa, Mastercard, Amex, Apple Pay, and Google Pay, with no monthly fees—just a 1.5% transaction fee.

A standout feature is the built-in 4G with unlimited data, so you can process payments anywhere, even without Wi-Fi. Plus, payments are cleared within 1-3 working days, helping maintain smooth cash flow.

However, the Tide Card Reader is only available to Tide business account holders, and it does not have a built-in receipt printer—only digital receipts are provided. Consider the Tide Card Reader Plus if you need a physical receipt printer. Overall, it’s a solid choice for businesses that need a reliable, low-cost card reader with built-in connectivity.

Drop us an email

Drop us an email and we'll get back to you soon.

Alternative Payment Services

Discover secure and flexible payment solutions beyond traditional gateways for seamless transactions.

Flexible payment option with no monthly fees—pay only for what you use.

Process secure in-person transactions using card readers or mobile payment solutions.

Enable secure and convenient digital transactions through websites and apps.

Process card payments securely from any device without a physical card reader.