Online Payments

When looking for a payment provider, consider the following: Acceptability, Risk and Compliance, Security, Reporting, and analytics.

There are many factors to consider, including debit and credit card fees such as payment solutions for all payment devices, Gateway integration, accounts integration, authentication, and much more.

Online payments are an essential part of any online business, but it’s important to remember that there are a variety of different payment providers out there, each with their own unique features and capabilities.

Payment providers have different services and fees, which you will have to consider. To help you make the right choice, review the provider’s pricing, supported countries, card funding options, and customer service reputation.

We can help you navigate through the technical jargon to arrive at an online payment solution that’s right for your business.

All our approved online providers are FCA-regulated financial institutions.

Virtual Payments

In today’s world, taking payments online isn’t just convenient, it’s essential. Whether you run an e-commerce store, take bookings online, or invoice clients for remote services, we help you get set up with secure, reliable, and cost-effective online payment solutions.

We work with top UK providers to match your business with the right tools to take payments through:

Payment links (sent via email, SMS, or WhatsApp)

Online checkouts for websites and e-commerce

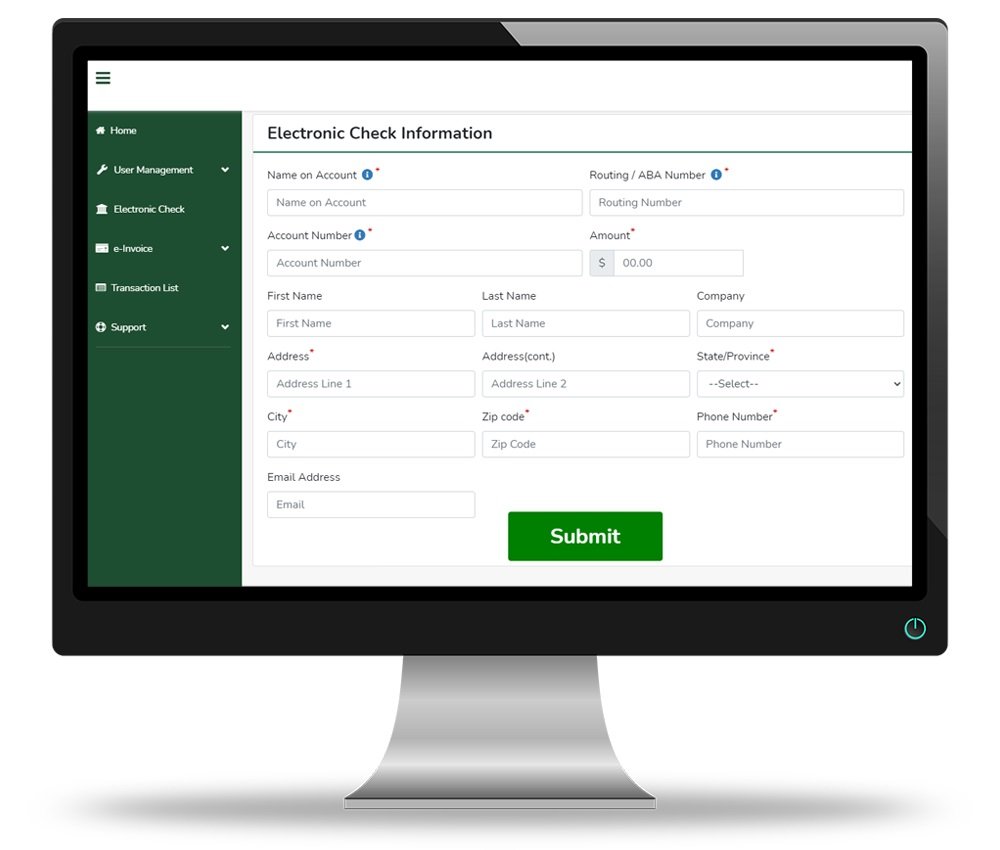

Virtual terminals for taking card details over the phone

Recurring payments for subscription or membership-based businesses

Digital invoices with built-in payment options

Questions and Answers

I don’t have a website, can I still take online payments?

Yes! You don’t need a full website to accept payments online. We offer Pay by Link and digital invoicing options that let you send a secure payment link to your customers via email, SMS, or even WhatsApp.

What’s the difference between a payment gateway and a virtual terminal?

A payment gateway is used to process payments through your website (e.g., e-commerce checkout), while a virtual terminal lets you manually enter a customer’s card details to take payments over the phone or by email, no website required.

Will a payment gateway work with my shopping cart?

Our partners have payment gateways that work with over 50 of the most popular shopping carts.

Can the gateway work alongside PayPal

Yep, most of our providers will integrate alongside PayPal. In many cases, they will already have PayPal build into their gateway.

Are online payments secure?

Absolutely. All of the solutions we recommend are PCI DSS-compliant, use SSL encryption, and offer fraud protection tools to keep both your business and your customers safe.

How long does it take to get set up?

In many cases, you can be ready to accept online payments within 24 to 48 hours, depending on the provider and type of solution. We’ll help speed things up and guide you through the process.

Alternative Payment Services

Discover secure and flexible payment solutions beyond traditional gateways for seamless transactions.

Flexible payment option with no monthly fees—pay only for what you use.

Process secure in-person transactions using card readers or mobile payment solutions.

Process card payments securely from any device without a physical card reader.