Virtual Terminal

A virtual terminal is a web-based application that allows businesses to process card payments manually using a computer, tablet, or smartphone, without needing a physical card reader.

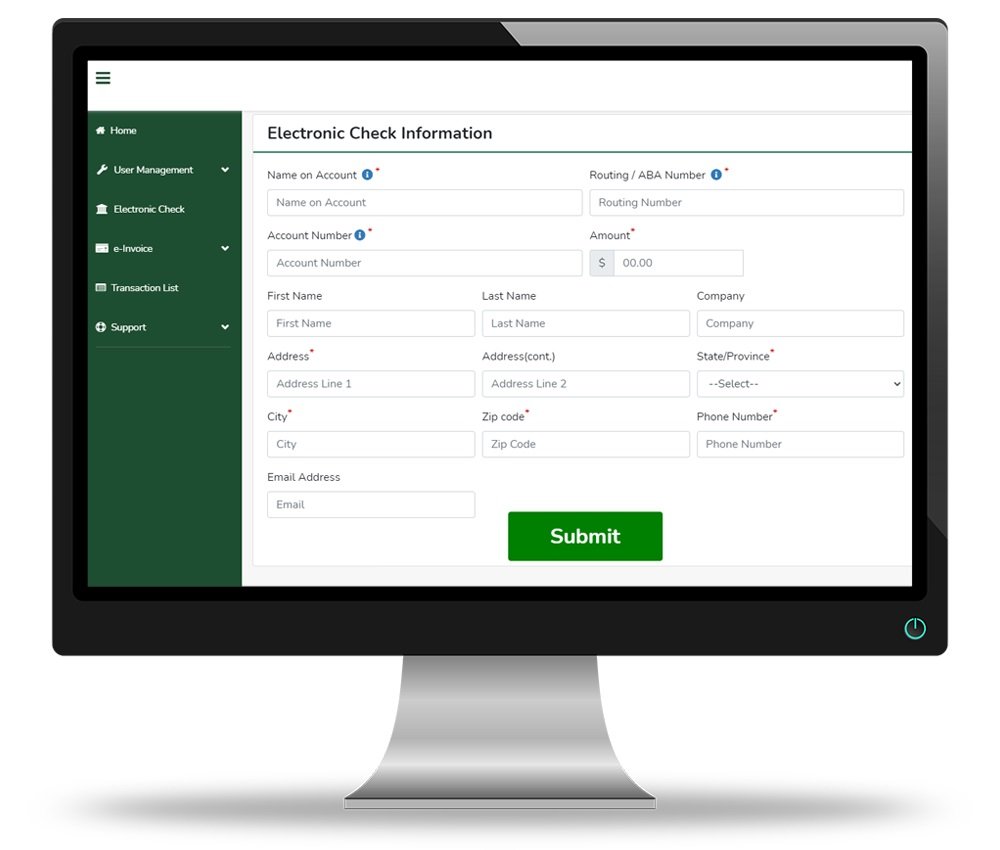

You simply log in to a secure online portal provided by your payment processor, and manually enter the customer’s card details (name, card number, expiry date, CVV) along with the transaction amount. Once submitted, the payment is processed just like an online transaction.

A Virtual Terminal is the perfect solution to take payments over the phone, which is ideal for online businesses or telephone orders.

Why use a Virtual Terminal?

Take payments from anywhere

Take remote payments from your customers no matter where they are in the UK. All they need to do is call with their card details at hand.

Easy to set up

Virtual terminals are straightforward to use and you don’t need to be a technical whizz to get started.

It’s quick and simple

You’ll give your customers a quicker way to pay. No more long waits for an invoice or until they can see you in person.

Connect with more customers

Reach out to people outside your local area by giving them a way to pay remotely. They can simply call up to make their order and pay.

Real time reporting

You get real-time reporting too, which helps you keep track of your payments.

FAQ's

Why should I take payments over the phone?

It’s simple. You can take faster payments from your customers. You won’t need to wait up to 30 days for an invoice or until your customer can pay in person. Instead, you sign into the virtual terminal, take their details over the phone, and enter them into the system.

You can reach out to more customers because they don’t need to be there to make payment. So, if you want to run adverts and promotions to customers further away than where you’re based – you can!

What payments can I accept with a virtual terminal?

You can take payments using all the main credit cards and debit cards such as Visa Debit, Visa Credit, MasterCard and even American Express.

How secure are phone payments with a virtual terminal?

The virtual terminal is equipped with the latest security, so you can safely take payment. To protect your customers from fraud, you can use security checks including:

- Address Verification System (AVS) – where your customers are asked for their billing address details.

- Card Verification Value (CVV or CV2) – where your customers are asked to provide their card security code.

So, when you take payment, the details are checked with what’s stored with their bank to check that they own the card.

All our phone payment systems are also PCI compliance. PCI compliance is the security standard backed by credit card and debit card companies like Visa, Mastercard and Maestro. It means you’ll have all the right controls in place to protect yourself and your customers when they pay.

Alternative Payment Services

Discover secure and flexible payment solutions beyond traditional gateways for seamless transactions.

Flexible payment option with no monthly fees—pay only for what you use.

Process secure in-person transactions using card readers or mobile payment solutions.

Enable secure and convenient digital transactions through websites and apps.